Resisting the gold rush: Dalradian Resources and the struggle against gold mining in Ireland

Communities in County Tyrone in Northern Ireland have been resisting proposals by the US-owned company Dalradian Resources to build a gold mine in the county. The company promises jobs and investment but local people fear the Curraghinalt mine will be a disaster for the area. Much of the 120,000 hectares of land that have already been acquired by Dalradian lies within the Sperrin Mountains, a designated Area of Outstanding Natural Beauty. Campaigners say that mining would poison the water table and rivers on the site.

So who is behind Dalradian Resources, where do they get their money from – and how can the company be resisted? A Corporate Watch investigation into the company has found:

Key points:

- Dalradian Gold Ltd is a mineral exploration and development company focused on exploiting the Curraghinalt gold deposit in Northern Ireland. Its immediate parent company is Dalradian Resources Inc., registered in Canada.

- But the ultimate owner is Orion Resource Partners, a New York-based investment fund that was founded by financier Oskar Lewnowski.

- Dalradian’s Directors – Brian Kelly, Keith McKay and Eric Tremblay – are also directors of Minco PLC, a company connected to controversial mining projects across the world

- Dalradian state that “As in everything we do, we will leave the site responsibly, and sustainably”. This claim is dismantled by evidence of the owners’ behaviour around the world and their legacy of environmental devastation.

A history of pollution

Dalradian submitted a 10,000 word planning application for the Curraghinalt mine in November 2017 to the Department for Infrastructure in Northern Ireland. If the project gets permission, construction could begin in 2020.

Experience from the rest of the world shows gold mining can have devastating impacts on the environment and public health and communities in the region are organising hard against the plans. Groups such as Save our Sperrins, Cooperate against mining in Omagh (CAMIO), Love Tyrone and Communities Against Mining are taking action in any and all ways they can.

There have been public meetings and demonstrations, while campaigners have even locked themselves to exploratory drilling equipment.

Local resident Emmet McAleer was recently elected as an Independent Councillor specifically to resist the project in local government. Residents also started Greencastle People’s Office as a community base opposing the project. Fermanagh and Omagh District Council is now trying to evict the office.

The groups resisting the project have also been linking up with other communities around the world who are opposing gold mining and other extractive industries in their regions.

In response, Daladrian has dropped its initial plans to use cyanide as part of the extraction process but campaigners remain opposed to the project. They say that the mining and the mercury smelting involved would poison the water table, the Owenkillew Rivers, special areas of conservation, and the Foyle and Ballinderry River Systems.

Health impacts on mineworkers and local communities have been documented around goldmines worldwide, including decreased life expectancy, increased frequency of cancer, pulmonary TB and silicosis, hearing loss, and more. Peatland would also be destroyed if the mine goes ahead.

The Curraghinalt site already has a history of pollution incidents. Dalradian has been accused of disregarding discharge limits during test drills and residents are not confident that the company will keep its promises once planning permission is secured.

Many mining companies disappear or go bankrupt before the time comes to clean up after their operations. Pegasus Gold in Montana, for example, went bankrupt after it had started mining operations, leaving the state of Montana and the Bureau of Land Management to pay $77 million in clean up costs, including over $2 million per year on water treatment plants.

Northern Ireland’s heavy rainfall aggravates the risks of heavy metals leaking into the groundwater from the site’s mammoth waste rock storage area, backfill and tailings ponds that store the inevitable waste from the operations. There are also huge concerns about the traffic, fugitive dust, and impacts of the 4.3 million litres of diesel each year that the project would burn.

For local people, the mine’s proximity to a village with a primary school, playgroup, community centre, and church adds another level of concern and outrage.

Dalradian Gold

Dalradian Resources Inc is a Canadian mining company which was bought in 2018 by Orion Resource Partners, a New York-based investment fund.

Dalradian is operating in Ireland through its Irish subsidiary Dalradian Gold Limited, a mineral exploration and development company focused on exploiting the Curraghinalt gold deposit. Dalradian Gold was founded in 1971 but its activities were delayed due to the troubles. Dalradian bought the licenses, mineral and surface rights from Tournigan Gold Corporation in October 2009.

Dalradian Gold Limited is registered in Northern Ireland under registration number NI008465. Its registered office is 3 Killybrack Road, Killybrack Business Park, Omagh, Northern Ireland, BT79 7DG.

Dalradian Resources Inc was listed on the Toronto Stock Exchange until June 2018, when it was bought out by Orion Mining Finance for $437 million Canadian dollars (around £250 million). Orion Mine Finance already had a 20.4% stake in Dalradian before making its move to purchase the company in its entirety.

Orion Mining Finance is a business arm of Orion Resource Partners, a “global alternative investment management firm with approximately $5 billion under management”. It invests in various parts of the mining and precious metals industry, sometimes buying companies like Dalradian outright, other times funding specific ventures.

Orion Resource Partners has offices in New York, Bermuda, London, Denver, Sydney and the Cayman Islands. Click here to find the address of each office.

Who’s behind Dalradian?

Oskar Lewnowski

Image source: https://www.mining.com/this-guy-is-launching-a-new-hedge-fund-to-invest-in-metals/

Who makes the decisions? Sitting at the top of the hierarchy is Oskar Lewnowski, the New York financier who founded Orion in 2004. As the boss of Daladrian’s new owner, he has ultimate responsibility for the overall strategy and operations of the company.

Lewnowski started Orion as an offshoot from the Red Kite Group investment firm, where he worked for ten years. In 2013, he turned one of Red Kite’s mining funds into a new company, taking much of the Red Kite management team with him.

Lewnowski had founded Red Kite with a UK businessman called Mike Farmer. Now Lord Farmer of Bishopsgate, Lewnowski’s former business partner is a major Conservative Party donor who gave more than £2.3 million to the party between 2001-2010, and was later appointed its Treasurer.

Farmer is known as ‘Mr Copper’ in finance circles for his activity in the world metals market – but he is currently being chased for unpaid fees after one of his funds closed. His son manages the UK chapter of Turning Point, a right-wing student group set up in the United States with controversial links to white supremacists.

Before Red Kite, Lewnowski was Director for Corporate Development at Varomet Ltd, a metals processor and merchant firm that was formed to purchase Enron’s metals and mining assets. He started off his career in investment banking at Deutsche Bank and Credit Suisse.

Lewnowski also currently serves as a board member of cannabis company Origin House (previously known as CannaRoyalty Corp). This company is based in Canada but is a major player in the budding (sorry) United States cannabis market.

Lewnowski is also a Director of Osisko Gold Royalties, the fourth largest precious metals ‘royalty’ company in the world (see more on Osisko below).

Dalradian’s Management Team

The people running Daladrian’s day to day operations in Ireland have a history of involvement with controversial mining projects.

Daladrian Gold Ltd’s Managing Director Brian Kelly joined the firm in 2014. Prior to that he ran CEMEX’s operations in Ireland. Cemex is a Mexican multinational targeted by pro-Palestine campaigners worldwide for their cement plants in occupied Palestine, after it bought the Israeli company Readymix Industries in 2005. Readymix produces and supplies materials for the construction industry, including concrete for the construction of Israel’s illegal wall along the Gilo bridge in the occupied West Bank, plus other military check points and settlements.

Daladrian Gold Ltd’s Chief Financial Officer is Keith McKay, a Canadian with extensive experience in the mining industry. Prior to Dalradian, he was CFO at Continental Gold, Andina Minerals and Aurrelian Resources. SOURCE Continental Gold hit the headlines last year when three of its staff were killed and several others injured after an attack on a residence that housed exploration geologists and contractors in Colombia. Continental is subject to massive community resistance in the country because of the forced displacement of people, environmental issues and conditions for workers. Andina Minerals are behind the Volcan gold project in Chile while Aurrelian Resources manage the Fruta del Norte Project in Ecuador.

Eric Tremblay joined as Chief Operating Officer in March 2015. He was the General Manager at Canadian Malartic, the largest open-pit gold mine in Canada, near the small town of Malartic, Quebec. The mine has faced an ongoing class action lawsuit from residents who want to be compensated for damages related to dust, noise and explosions.

Who profits from Dalradian?

For all its talk of bringing jobs and respecting the environment, the record of Dalradian’s owners shows a company more concerned with rewarding financial investors.

Orion’s most recent Mine Finance Fund closed after generating $2.1 billion from investors. Such funds rarely disclose their investors, but trade press reports say they include the pension funds of US state government workers.

These include: the Florida State Board of Administration, the Washington State Investment Board, the Texas Municipal Retirement System, the Maine Public Employees Retirement System and the Arizona Public Safety Personnel Retirement System. The University of Michigan has also put money into Orion, according to reports.

Without its investors, Orion would not have the financial muscle to buy companies like Dalradian. Campaigners may want to contact the public sector workers in these states to tell them what their pension funds are being used for.

Making Mining Millionaires

Inevitably, all of these enterprises have made Lewnowski very rich. Firms like Orion manage other investors’ money and take a cut from the profits. As the founder and boss it seems safe to assume that Lewnowski will take a particularly big cut. But it is difficult to know exactly how much.

Orion is based in the US state of Delaware, with key subsidiaries in tax havens such as the Bahamas and the Cayman Islands. None of these jurisdictions require companies to disclose details of their financial affairs. But the information that is public suggests Lewnowski has made an impressive fortune. It is estimated that he made around $60 million from Red Kite, the former parent company of Orion, in just the five years between 2006 and 2010.

Can Dalradian be trusted?

Dalradian’s publicity tries to give a strong impression that they take social and environmental responsibility seriously. Their sponsored content in the Ulster Herald newspaper ends with “as in everything we do, we will leave the site responsibly, and sustainably”.

But the record of Dalradian’s owners and directors tells a very different story. As mentioned above, its managers have previous form running other extremely controversial mining projects across the world. Here are a few further examples of Dalradian’s connections to destructive activities.

Osisko Gold Royalties

Dalradian’s ultimate boss Oskar Lewnowski is also a Director of Osisko Gold Royalties, the fourth largest precious metals ‘royalty’ company in the world. Osisko Gold Royalties is also a minority shareholder of Dalradian.

The Osisko empire includes Osisko Mining Inc., Falco Resources Ltd., Barkerville Gold Mines Ltd and Osisko Metals. Osisko’s business model is based on acquiring “royalties” in gold mines: a royalty is the right to receive a share of mineral production from a mining operation. It also invests in mines in other ways, for example though “offtake agreements”: where it agrees with the mine owner to buy portions of its future production.

Image source: https://osiskogr.com/en/

Through royalties, offtakes, and other deals, Osisko profits from gold mines in Australia, Armenia, Brazil, Canada, Chile, Ireland, Kenya, Macedonia, Mauritania, Mexico, New Zealand, Peru, Puerto Rico, Spain, Sweden, Turkey, United Kingdom and the United States.

You can see a map of its assets here. You can download a full list of its royalties, streams and offtakes here: OR-Royalties05-2019

In Macedonia, the tailings material from Sasa Mine, from which Osisko Gold receives 100% of the royalties from, contain very high amounts of toxic metals and represents a high environmental risk for surrounding ecosystems. Further research into the project by the University of Ljubljana showed higher bioaccumulation of metals in animals that can consequently harm human health, especially children in their early development stages.

Osisko’s income from Base Resources in Kenya is the outcome of years of local conflicts and enforced displacements of 5,000 indigenous Digo and Kamba people. People are still occupying land in resistance to the titanium mine there.

In general, gold mining fuels conflicts over land all over the world, as many communities contend with the toxic legacies of the industry.

Minco PLC

In August 2017, Dalradian Resources bought Irish company Minco PLC. Dalradian’s managers Brian Kelley, Keith McKay and Eric Tremblay now also serve as directors of Minco along with Marla Gale, Daladrian’s communications director.

Minco has a wide portfolio of companies with a variety of controversial projects. Here we list some of these.

Westland Exploration

Westland Exploration is a subsidiary of Minco. It is working with Swedish company Boliden to explore for more zinc and lead adjacent to Europe’s largest existing zinc mine in Navan, Ireland. The project has generated negative publicity for decades. Five people have lost their lives in the mine and underground fires and rescues have also featured.

Swedish company Boliden operates large mines across Scandinavia and have faced resistance from indigenous communities due to the impact on reindeer herding of the Semisjaur Njarg Sami community.

Image source: https://www.boliden.com/globalassets/operations/mines/aitik/aitik_produktionsbild.jpg/SmallImage

Boliden is also facing a huge legal battle after Boliden paid Chilean company Promel to dispose of 20,000 tonnes of smelter sludge that contained arsenic, mercury, lead and other heavy metals. More than 5,000 people had been exposed to the toxic chemicals leading to major health impacts including cancers, birth defects, high rates of miscarriage and neurological disorders.

Minco in North Pennines, England

Minco has been signing agreements and licenses with owners of mineral rights in the North Pennine Orefield located in the counties of Cumbria, Northumberland and Durham in northern England. It ran an extensive drilling programme from 2012 to 2015 in order to ascertain viability for mining for zinc, lead and silver. After spending £1.7 million on exploration, the firm slowed down their plans when zinc prices tumbled.

Research shows that historical mining in the North Pennine Orefield continues to pose an environmental problem, with pollution of the River Wear by lead mining waste. The Wear Rivers Trust says:

“Abandoned metal mines cause significant pollution in England and harm fish and river insects. They contribute up to half of all the metals, like cadmium, lead, zinc and copper, found in our rivers, streams and lakes. Most mines closed more than 100 years ago but continue to pollute about 1,500km of rivers. These metals are one of the most widespread causes of chemical pollution in rivers.”

Minco’s other directors

The two registered directors of Minco Mining Ltd (a Minco subsidiary registered in the UK) are Danesh Varma and John Kearney. Danesh Varma, who is a Chartered Accountant and a listed director for 12 companies, is also a director of Anglesey Mining plc. This company owns the west part of Parys Mountain Anglesey, where a metal mine has polluted more than 10km of rivers and discharges into the Irish sea. The landscape can no longer sustain significant life due to the mine’s contamination and has even been used as a backdrop in Science Fiction films because of its impression of desolation. The Environment Agency reported “significant failure” in river quality compliance by the company and local residents now fear the site could become a potential nuclear waste storage site.

Image source: http://copperkingdom.co.uk/parys-mountain/

John Kearney is a mining executive with 44 years of experience in the mining industry. He is currently a director or senior officer of numerous mineral ventures including Buchan Resources, Labrador Iron Mines Holdings Limited, Anglesey Mining Plc, and Canadian Zinc Corporation and is also Chairman of Xtierra. He also serves as a director of the Mining Association of Canada.

Buchans Resources

Buchans in Canada

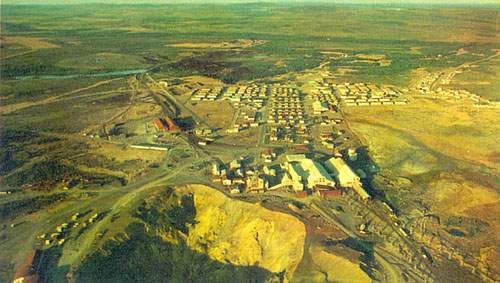

Another subsidiary of Minco (and so of Dalridian) is Buchans Resources. This company’s origins stem from a town called Buchans in central Newfoundland, Canada, where Buchans Resources has a base metal mining project.

The region has a long history of mining and resulting pollution. In 2009 residents of Buchans were asked to have blood tests after soil tests showed high concentrations of heavy metals, including lead, arsenic, uranium and copper. More than $10 million of state money has been spent on trying to clean up the polluted sites after the original company AbitibiBowater went bankrupt.

Buchans Resources plans to redevelop a mine in Buchans called Lucky Strike, which was originally owned by the American Smelting and Refining Company (ASARCO) and AbitibiBowater. ASARCO has a disturbing history of profiting from its mining operations whilst poisoning the people who extracted the ore. They have to pay a record $1.79 billion to settle claims for hazardous waste pollution at 80 sites in as many as 20 states.

Image source: http://www.digitaljournal.com/article/280392

Another Buchans Resources project in Canada is “The Woodstock Project” to produce electrolytic Manganese. The Woodstock project comprises 5,800 hectare near Woodstock in New Brunswick, Canada. Colonial New Brunswick is home to the Mi’kmaq and Maliseet first nations. There is a fierce history of indigenous resistance including Mi’kmaq opposition to extractive industries in the region, with protests and occupations against mining and fracking.

Buchans in Ireland: Moate

Buchans Resources is also active in Ireland, where it has acquired the Moate Property, located in County Westmeath, Ireland with an aim to mine for zinc, lead and copper. Prospecting licenses were granted by the Irish State in November 2015. Moate lies mid-way between the former Tynagh Mine, located 50 kilometres to the southwest, and the Ballinalack deposit, situated 35 kilometres to the northeast.

The Environmental Protection Agency labelled Tynagh Mines as the most hazardous mine site in the country, with arsenic levels 1,600 times higher than safety limits – posing a potential risk to thousands of people across East Galway. Tynagh is now recognised by the European Commission as the “main source of concern of heavy metal contamination in the country”. Responsibility is contested, with the government and the property owner passing the buck.

Buchans in Mexico: Xtierra Inc.

Buchans also has an investment in base metal and silver projects in Mexico through its 22% share in Xtierra Inc. The company’s focus is the development of precious and base metal projects in the State of Zacatecas, Mexico. Their primary project is the Bilbao silver-zinc-lead-copper deposit situated in the Panfilo Natera district of Zacatecas. They also own the La Laguna silver-gold tailings project in Zacatecas.

Canadian mining corporations have a grim history in Mexico. The Commission for Environmental Cooperation researched in detail the polluting effects of North American mining companies in Mexico, Canada and the United States. Out of 290 mining companies operating in Mexico, 211 are Canadian. Mexico has the least strict mining regulations in the North American Free Trade Agreement (NAFTA) area.

Grassroots group the Mexican Network of Those Affected by Mining (Rema) writes that mining has caused more than 15,000 social conflicts in Mexico. Workers have been killed during strikes, and public organisers have been assassinated. In a public statement, Rema wrote:

“Health harms, environmental contamination and destruction, criminalization of social protest, threats, harassment, smear campaigns, surveillance, arbitrary detentions and the assassination of defenders are the formula for progress and development that Canadian mining investment has brought to our country. To counteract its brutality, in the media and among the spheres of power, companies gloat about their corporate social responsibility, clean industry certification or safe cyanide use, or their adherence to absurd standards of “conflict free gold” that are supported and certified by organizations largely created by the very same corporate sector.”

Conclusion

In order to stop Dalradian’s destruction of the beautiful Sperrin mountains and the human and ecological life that currently flourishes there, widespread resistance is needed. Local communities on the frontline of resisting Dalradian will need global solidarity to defeat the project. The health of future generations may depend on it.

Learn more about the campaign at: