The Wreckers of the Earth: London company directory

OCTOBER 2021 NOTE: This version of the directory is now out of date. For an updated version, see here

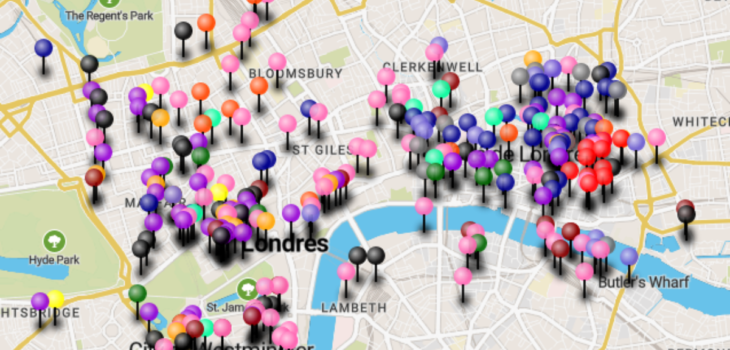

Our new “Wreckers of the Earth” map of London identifies planet-killing companies based in the city, giving their addresses and short descriptions. This directory, accompanying the map, presents all the company information in one document. It also features sector introductions which explain a bit more about the roles these companies play.

London is one of the main global hubs of ecocidal capitalism. London is home to fossil fuel giants and to many of the worst mining polluters. It is the world’s second largest financial centre (after New York). It is the key financial marketplace for Europe, the Middle East and Africa, and for trading oil, metals, minerals and other “commodities” sucked out of the earth. Lax regulation and tight security make London a money-laundering haven for the world’s tyrants, oligarchs, and billionaires. The legacy of the British empire still lives in the infrastructure and services London offers: insurance markets, law firms, arms dealers, PR agencies, down to prestige shopping and investment property.

To break things down, we identify three main categories of wreckers in this directory:

- Primary planet-killers: companies on the “front lines” of ecological devastation. Oil, coal and gas companies, mining giants, agribusiness empires, plastics or cement producers, and other major polluters.

- The facilitators: the banks, investment funds, insurers, law firms and security companies who provide the supply lines and services without which the “front line” companies couldn’t function.

- Ideology industry: the institutions promoting and normalising environmental destruction, runaway growth, and the profit motive. Including media, academic units, think tanks, lobbyists, PR firms, and the new boom industry of specialist “greenwashing” initiatives.

Our list is not comprehensive – there are more London-based companies working in these industries than we include here. We have prioritised those with the biggest global scale, plus others we think are worth highlighting in certain areas.

NB: this information was compiled and checked in February 2020.

Table of Contents

1.1.1 The national oil companies

1.1.2 The multinational “oil majors”

1.2 Hydrocarbons: smaller oil companies, frackers and UCG

1.2.1 Smaller “conventional” oil and gas companies

1.2.2 The frackers: “unconventional fossil fuels” specialists

1.3 Oil and gas services and shipping

1.3.3 Oil shipping and gas pipelines

1.4 Non-fossil energy: nuclear, biomass, dams …

1.4.3 Dams: hydropower companies

1.5 Mining: metals and minerals

1.6 Earth-killing infrastructure: engineering and construction

1.6.2 International engineering and construction giants

1.8 Plastics and other chemical polluters

2. The facilitators

2.1.2 Top 20 multinational investment banks

2.1.3 Multilateral development banks

2.1.4 Smaller specialist banks

2.2.1 Top 20 Institutional Investors

2.2.5 Smaller earth-wrecking specialist investors

2.4 Other finance sector institutions

2.4.1 Auditors: the Big 4 accountancy firms

2.6.2 PSMCs (Mercenaries and security firms)

3. Ideology industry

3.2.3 Newspapers (and news websites)

“The earth is not dying, it is being killed, and those who are killing it have names and addresses.” Utah Phillips

Capitalism is burning up our planet, devastating ecosystems and communities in its ceaseless hunger for profit. Everything is for sale, and the one great goal is growth: producing and consuming ever more stuff, even as it kills us. This engine of mass destruction is driven by burning forests: the long-dead forests of fossil fuels, and the living forests of today.

Though we all play our parts in the consumer system, some people play much bigger parts than others. The people killing the earth are those directing the machine – and crushing any resistance to it.

Our “Wreckers of the Earth” project has two aims: to identify the main planet-killers based in London; and to show how they work together as a coordinated system of power and profit.

Our list is not comprehensive – there are more London-based companies working in these industries than we include here. We have prioritised those with the biggest global scale, plus others we think are worth highlighting in certain areas.

This project builds on the work of a number of other people and groups, highlighted in the text, and we hope it will encourage future work by others. Future work by us will investigate the links, from investment to ideas, that connect these together.

We have chosen to focus on London because it is the UK home for the most multinational companies, their financiers and other backers. Plus we don’t have the capacity to do the same exercise for the whole of the UK right now. But if you would like to do something similar for another city or town and want to hear about how we’ve put this together, get in touch.

Here we only identify the companies. Lots more could be done to investigate them further: to find out more about their business, key contracts or operations, which individuals are making the decisions, who is profiting, and so on. If you’re interested in this, have a look at our ‘Do-It-Yourself’ handbook, and sign up to news update emails to hear about the trainings we run.

1. Primary planet-killers

1.1 Hydrocarbon majors

The companies in this section provide the fuel that is burning the planet. “Big oil” includes the massive state-backed extractive industries of Saudi Arabia, Iran, Russia, China, and the other major oil-soaked states. And alongside them the multinational “supermajors” – private corporations including BP, Shell, ExxonMobil, Chevron, Conoco Philips, Total, and Eni. Between them these companies are responsible for the supply end of much of the world’s greenhouse gas emissions.

London is a major centre for big oil and gas. BP is headquartered here. Shell is incorporated in London, and runs many of its operations from here. Most of the other major firms have London offices. Even those without London locations have connections to London-based finance, insurance and other companies (listed in Part 2).

The descriptions below give very brief glimpses into their impact on the world. The companies in this section cause oil spills and other pollution disasters, instigate wars and massacres, bankroll authoritarian regimes, suppress revolutions and popular movements, destroy indigenous communities, disrupt ecosystems and wildlife habitats on a massive scale. Their publicly recorded trails of destruction already fill volumes – but many more of their activities may never come to light, thanks to the enormous power and violence they wield.

Some useful sources and further information: Platform “Carbon Web” mapping of BP and Shell connections; Environmental Justice Atlas (EJA); Exxon Secrets (NB: Exxon’s UK base is outside London). For some more in-depth reading see: Burning Up – A Global History of Fossil Fuel Consumption, by Simon Pirani. We have referred to the CDB’s “Carbon Majors database” report listing major carbon emitters in the list below – this shouldn’t be taken to fully endorse their methodology, but it gives a useful glimpse of the scale of the problem.

Note: what about coal? This section doesn’t include the other big group of hydrocarbon planet-killers – the coal companies. Some multinationals involved in coal mining – notably, Glencore and RWE – are listed in the mining section below. However, the world’s very biggest coal producers are largely state-owned corporations – notably the massive Coal India Ltd, and the various Chinese coal companies – which do not have a presence in London. The world’s biggest private sector coal miner, US corporation Peabody Energy, has a “London” office that is actually in Guildford. On the other hand, many financiers of the coal industry are here: these are listed in Part 2.

1.1.1 The national oil companies

The world’s biggest oil and gas drillers are state-owned corporations run by the main fossil fuel producing nations. At the top of the list are the giants controlling the gulf oil fields of Saudi Arabia and Iran, and Russia’s vast gas reserves.

Saudi Aramco

Aramco Overseas Company: 10 Portman Square, Marylebone, London, W1H 6AZ

Source: https://europe.aramco.com/en/info/contact-us

Saudi Arabia’s national oil company. It is the world’s biggest single greenhouse gas emitter – responsible for 4.5% of all the world’s carbon emissions between 1988 and 2015, according to Carbon Majors Database. A minority of its shares were recently listed on the country’s local stock exchange but it remains majority owned by the tyrannical Saudi state.

Owners: majority owned by Saudi Arabia. A minority of shares are traded on the Saudi stock exchange.

Gazprom

20 Triton Street, London, NW1 3BF

Source: http://www.gazprom-mt.com/HowToFindUs/Pages/default.aspx

Massive Russian gas company, the world’s biggest natural gas producer. Responsible for an estimated 3.9% of all global carbon emissions in 1988-2015, according to Carbon Majors Database. Gazprom is a leading player in drilling new oil and gas fields opened by retreating ice in the Arctic.

Ownership: majority owned by Russian government. A minority of shares are traded on the London, Frankfurt and Moscow stock exchanges. Shareholders include BlackRock, Vanguard, and the other big investment funds profiled below in Part 2.

National Iranian Oil Company

NIOC House, 6th Floor, 4 Victoria Street, London, SW1H 0NE

Source: http://www.iocukltd.co.uk/contact.php

Iran controls the world’s second biggest oil fields after Saudi Arabia. These contributed 2.28% of global carbon emissions in 1988-2015, according to Carbon Majors Database. In 2018 the collision of an Iranian oil tanker in the East China Sea was one of the worst oil shipping disasters in decades, killing all 32 crew members and causing three huge oil spills.

Ownership: Iranian government. Iran’s oil was formerly owned by the Anglo-Iranian Oil Company, the ancestor of today’s BP, before nationalisation in 1954.

China National Petroleum Corporation (CNPC)

5 Wilton Road, London, SW1V 1AN

Source: http://chinachamber.org.uk/index.php/en/member-list/403-petrochina-international-london-co-ltd

CNPC is the Chinese state oil company, responsible for 1.56% of global carbon emissions in 1988-2015, according to Carbon Majors Database. Its 2010 Dalian oil spill caused an oil slick stretching over at least 183 square kilometres off North East China.

Owners: the government of China. CNPC also has a publicly listed susidiary, called Petro China, whose shareholders are a mixture of Chinese banks and funds, along with the big global investment funds profiled below in Part 2.

Petróleos de Venezuela (PDVSA)

7 Old Park Lane, London, W1K 1QR

Source: http://www.pdvsa.com/index.php?option=com_content&view=article&id=6581&Itemid=898&lang=en

Venezuelan state-owned oil and natural gas company, responsible for 1.23% of global carbon emissions in 1988-2015, according to Carbon Majors Database. Venezuela is the fifth largest oil exporting country in the world. Severe safety concerns have been raised about PDVSA’s working practices, in particular after a 2012 refinery explosion left 42 people dead and destroyed 1,600 homes. After Canada, Venezuela is the world’s leading producer of tar sands oil, as developing technology allows exploitation of the vast “extra heavy crude” deposits in the Orinoco Basin.

Kuwait Petroleum Corp

KPC House, 54 Pall Mall, London, SW1J 5JH

Source: https://www.kpc.com.kw/Pages/European-Regional-Office.aspx

Kuwait’s state-owned national oil company. Responsible for 1% of global carbon emissions in 1988-2015, according to Carbon Majors Database. The company has plans to increase oil production by 7.3% between 2018-30.

Sonatrach

Sonatrach Gas Marketing: 1st and 2nd floors, Panton House, London, 25 Haymarket, SW1Y 4EN

Source: https://www.sonatrach-uk.com/contact-us/

National state-owned oil company of Algeria. It is the largest company in Africa and is planning overseas expansion. Responsible for 1% of global carbon emissions 1988-2015, according to Carbon Majors Database. In July 2019, the company suffered its worst accident in 15 years when a huge liquefied natural gas complex exploded.

Petrobras

1 Angel Court, London, EC2R 7HJ

Source: http://www.petrobras.com.br/en/petrobras-worldwide/

Brazil’s national oil company. Responsible for 0.77% of emissions between 1988–2015 according to Carbon Majors Database. Responsible for a long list of oil spills, and mired in long-running corruption scandals.

Owners: Over 40% state owned. Other shares are traded on the Sao Paulo and New York exchanges, and held by Brazilian and global investment funds.

Nigerian National Petroleum Corporation (NNPC)

159 Hammersmith Road, London, W6 8BS

Source: https://www.nnpcgroup.com/CorporateServices/Pages/LondonOffice.aspx

The Nigerian government oil company. The Niger Delta basin is the site of Africa’s biggest oil and gas fields, which account for the majority of Nigeria’s export income. The Nigerian oil industry is run by joint ventures between NNPC and the “supermajor” multinationals – above all, Shell. In contrast to the wealth being sucked from the ground, the people of the Niger Delta live with massive environmental damage from oil spills and gas flaring, extreme poverty, and vicious repression in a zone militarised by the state and multinationals to protect oil profits.

Socar

2 St. James’s Market, London, SW1Y 4AH

Source: https://www.socartrading.com/contact

The state-owned petrochemical company of the oil and gas-rich central Asian state of Azerbaijan. Azeri gas is becoming a major geopolitical commodity as European governments build costly and environmentally devastating pipelines from the country to try and escape dependence on Russia’s Gazprom.

Rosneft

Rosneft Marine UK : Office 461, 1 Kingdom Street, Paddington Central, London, W2 6BD

Source: http://www.rosneftmarine.com/locations/

Russian oil giant, active worldwide but particularly in Siberia, the Arctic, and former Soviet territories around the Black Sea. Chairman of the board is former German chancellor Gerhard Schroeder.

Owners: 50% owned by the Russian government, the other 50% publicly traded. BP owns around 20% of the public shares, and QH Oil Investments – a Qatari state company – just under 19%.

1.1.2 The multinational “oil majors”

The “oil majors” (or even “supermajors”) is the name often given to the top flight of privately owned oil and gas multinationals. Most lists include the three big US-based firms – ExxonMobil, Conoco Philips, and Chevron; as well as Total from France, Britain’s BP, and the Anglo-Dutch company Shell. Eni, based in Italy, and Russia’s biggest privately-owned company Lukoil are also of a similar scale.

Despite their historic national affiliations, all these companies are largely owned by the same international investors – the likes of BlackRock, Vanguard, and the other massive investment funds we profile in Part 2 below.

BP

Global HQ: 1 St James’s Square, London, SW1Y 4PD

Supply and Trading (IST) office: 20 Canada Square, Canary Wharf, London, E14 5NJ

Source:https://www.bp.com/en_gb/united-kingdom/home/where-we-operate/london.html; https://www.bp.com/en/global/corporate/what-we-do/bp-at-a-glance/key-business-addresses.html

Oil and gas multinational headquartered in London. Has a bloody history of colonial exploitation, environmental devastation and violence, from its foundations in the Anglo-Iranian Oil Company to the world’s largest oil spill, Deepwater Horizon in 2010. BP contributed 1.53% of global carbon emissions in 1988-2015, according to Carbon Majors Database. In recent years the company has cynically tried to rebrand itself as a “green” energy company developing renewable sources – while in reality its business remains overwhelmingly focused on fossil fuels. It plans to spend £41 billion on new oil exploration in the next decade including projects in the Canadian “tar sands”, the Arctic National Wildlife Reserve, and the Amazon rainforest.

Royal Dutch Shell

Shell Centre, Belvedere Road, London, SE1 7NA

Source: https://www.shell.co.uk/about-us/contact-us.html

British-Dutch multinational oil and gas company, headquartered in the Netherlands and incorporated in the United Kingdom. Accountable for 1.67% of global carbon emissions in 1988-2015, according to Carbon Majors Database. Shell has no shortage of controversies; in particular it has been linked to the killing of the “Ogoni Nine”, including Ken Saro-Wiwa, as well as other horrific atrocities in the Niger Delta, where it is the main multinational oil exploiter. Shell, with Italian oil company Eni, is currently on trial in Italy over an alleged $1.3 billion bribery deal with a former Nigerian oil minister. In May 2016 an estimated 2,100 barrels of oil, nearly 90,000 gallons, spilled into the Gulf of Mexico – leaked from an undersea pipeline system operated off the Louisiana coast.

See also: Royal Dutch Shell: Corporate Rap Sheet, old Corporate Watch profile from 2005; Shell Must Fall campaign.

Owners: PLC listed on the London, Stock Exchange (LSE). The majority of shares are owned by the big investment funds profiled below in Part 2.

Chevron

1 Westferry Circus, Canary Wharf, London, E14 4HA

Source: https://group.canarywharf.com/office-occupier/chevron-uk/

US-based multinational oil company. Responsible for 1.3% of global carbon emissions in 1988-2015, according to Carbon Majors Database. And for a long list of oil spills, human rights atrocities, and much more. See the Environmental Justice Atlas for a map of social and environmental conflicts Chevron has a hand in.

Owners: PLC listed on the New York Stock Exchange (NYSE). The majority of shares are owned by the big investment funds – the likes of BlackRock, Vanguard, and others profiled below in Part 2.

ConocoPhillips

20th floor, 1 Angel Court, London, EC2R 7HJ

Source: https://www.conocophillips.co.uk/

American multinational energy corporation, created through the merger of Conoco and Phillips Petroleum Company in 2002. While maintaining a lower profile than other oil companies it has grown into the 3rd largest US oil company and been responsible for 0.91% of global carbon emissions in 1988-2015, according to Carbon Majors Database. Along with environmental degradation the company has a poor safety record in Texas, with more than two dozen workers killed in accidents and many others injured.

See also: “Corporate rap sheet” onthe Corporate Research Project website.

Owners: US PLC, owned by major investment funds.

Total SA

10 Upper Bank Street, Canary Wharf, London, E14 5BF

Source: https://www.total.uk/contacts-gb

French multinational oil and gas company, one of the six biggest “supermajor” oil companies. Responsible for 0.95% of global carbon emissions in 1988-2015, according to Carbon Majors Database. Responsible for one of France’s worst environmental disasters, the 1999 sinking of the tanker Erika and the subsequent oil spill.

Owners: PLC, main shareholders are big global investment funds.

Eni

Eni House: 10 Ebury Bridge Road, London, SW1W 8PZ

Eni Trading & Shipping: 123 Buckingham Palace Road, London, SW1W 9SL

Italian multinational oil and gas “supermajor”, active worldwide. It is the second main multinational, after Shell, involved in the Niger Delta – “one of the world’s most polluted regions”. Eni and Shell are currently on trial in Italy over an alleged $1.3 billion bribery deal with a former Nigerian oil minister. In an extremely rare case, the Eni CEO actually faces criminal charges.

Owners: 30% owned by the government of Italy. The remaining shares are publicly traded and owned by major global investors.

Lukoil

25 Canada Square, London, E14 5LB

Source: http://www.lukoil.com/InvestorAndShareholderCenter/Contacts

Russian oil and gas multinational headquartered in Moscow, and Russia’s second biggest company after Gazprom.

Owners: around 40% of shares are owned by its top managers. Other shares are traded on multiple stock exchanges, and owned by global investment funds.

NB important companies without a London location:

ExxonMobil is the other massive US-based oil company. It does not have a London office, but a base with some 600 employees nearby in Surrey: Ermyn House, Ermyn Way, Leatherhead, Surrey KT22 8UX.

Pemex (Mexican state oil company)

Peabody Energy (US oil and coal multinational)

Abu Dhabi National Oil Company

Iraq National Oil Company

1.2 Hydrocarbons: smaller oil companies, frackers and UCG

1.2.1 Smaller “conventional” oil and gas companies

Energean

3rd floor, Accurist House, 44 Baker Street, London, W1U 7AL

Source: https://www.energean.com/contact-us/

Greek-Israeli-UK oil and gas company racing to turn the Mediterrenean into an oil field. This company has grown fast in just a few years, thanks to capital injections from private equity investors and a warm relationship with the Israeli government. One of its projects is the first Israel-Cyprus gas pipeline. See our recent Corporate Watch profile.

Owners: major shareholders include “vulture fund” Third Point; oil-focused private equity fund Kerogen Capital; and Israel’s Bank Hapoalim, alongside the company’s founding partners. It also recently sold shares on the London, Stock Exchange, attracting the usual global investment funds such as BlackRock and Vanguard.

Neptune Energy

Nova North, 11 Bressenden Place, London, SW1E 5BY

Source: https://www.neptuneenergy.com/contact-us/

British “independent” oil and gas company drilling in the North Sea, North Africa and Asia. Set up in 2015 with backing from private equity investors (see Part 2), it has since grown fast by buying up several other companies.

Owners: single biggest shareholder is China Investment Corporation (CIC), followed by a number of private equity investors.

Premier Oil PLC

23 Lower Belgrave Street, London, SW1W 0NR

Source: https://www.premier-oil.com/contact

Long-running British oil “independent” with licenses in the North Sea and Falkland Islands, as well as Mexico and more. A listed company and member of the FTSE 250 index.

Perenco

8 Hanover Square, London, W1S 1HQ

Source: https://www.perenco.com/contact

Anglo-French oil and gas company with headquarters in London and Paris, calling itself “the leading independent oil and gas company in Europe”. It has exploration and production activities in 16 countries around the globe, particularly in Africa but also in Turkey, Vietnam, Australia, South America, and the UK. Has been accused of human rights violations in the Democratic Republic of Congo in the ‘poorest oil city in the world’.

Tullow

9 Chiswick Park, 566 Chiswick High Road, London, W4 5XT

Source: https://www.tullowoil.com/contact

London based oil company, founded in Ireland but now calling itself “Africa’s leading independent oil company”, pursuing exploration licenses in multiple countries in West and East Africa. Supported by the UK government through its January 2020 “UK-Africa Investment Summit”,which focused heavily on UK companies exploiting African oil and gas.

Seplat Petroleum

4th Floor, 50 Pall Mall, London, SW1Y 5JH

Source: https://seplatpetroleum.com/contact/

Nigerian oil company focused on drilling in the Niger delta – the scene of horrendous pollution from oil spills and gas flaring, extreme poverty, and vicious repression. Recently bought Eland Oil and Gas, another Nigerian-focused company.

Victoria Oil & Gas Plc

Scott House, Suite 1 The Concourse, Waterloo Station, London, SE1 7LY

Source: https://www.victoriaoilandgas.com/contact-us/

London based company that has gas drilling contracts, and a gas pipeline, in Cameroon. It is also exploring for gas in Russia.

1.2.2 The frackers: “unconventional fossil fuels” specialists

The economic growth machine drives seemingly endless demand for fossil fuel energy, depleting the sources of so-called “conventional” oil and gas supply. Luckily for the industry (if not the rest of us), new technologies help keep the motor going. They also create openings for newer companies specialising in fracking and other new extraction methods. For a deeper look at these issues, see our 2014 publication: To the Ends of the Earth: A Guide to Unconventional Fossil Fuels.

Following significant local campaigns and strategic direct action, the UK government has currently ordered a halt or “moratorium” on fracking in Britain. It very much continues elsewhere, with many of the same companies involved. Much of the information in this section comes from the excellent Frack Off. See also their “list of bad guys”.

NB: not in the list:Ineos, one of the biggest UK players in this game, is listed below in the chemicals section (1.8). The infamous Cuadrilla Resources is based in Preston, Lancashire.

IGas Energy

7 Down Street, London, W1J 7AJ

Source: https://www.igasplc.com/contact

Operator of the largest number of onshore oil and gas fields in Britain. Frack Off identifies it as one of the key companies in the drive to fracking in the UK, with aims to extract Coal Bed Methane (CBM) and Shale Gas in England and Scotland. It began to drill the first shale well in Nottinghamshire in November 2018, which was initially delayed by an 80-hour blockade of the site entrance. See: Powerbase profile.

Owners: listed on the LSE AIM exchange. Its biggest investor is energy private equity investor Kerogen Capital.

Angus Energy PLC

Building 3, Chiswick Park, 566 Chiswick High Street, London, W4 5YA

Source: http://www.angusenergy.co.uk/contact/

Angus Energy is a onshore oil and gas company which owns and operates two conventional production fields in Brockham and Lidsey, Southern England. It has a 25% stake in the Balcombe oil field, along with Cuadrilla, and is the operator there. (See also: Frack Off.)

Major Shareholders: Knowe Properties Limited (8.2%); Rupert Labrum (7.21%); JDA Consulting Limited (5.4%); Jonathan Tidswell-Pretorius (4.9%).

Cluff Natural Resources plc

Third Floor, 5-8 The Sanctuary London, SW1P 3JS

Source: https://www.cluffnaturalresources.com/contact-us/

Has shares in a number of oil exploration licenses in the North Sea. Was one of the UK’s most visible companies pushing for Underground Coal Gasification (UCG) companies, although currently says it is focusing back on North Sea oil. Founded by multi-millionaire Algy Cluff who made his fortune in gold-mining in Africa and North Sea Oil. (See: Frack Off.)

Owners: PLC listed on the LSE AIM exchange. Major shareholders: Canaccord (16.9%); IPGL (Michael Spencer) (16.8%); Lombard Odier (8.1%); Janus Henderson Investors (6.7%); Hargreaves Lansdown (5%); Fiske (4.5%); James Caird Asset Management (3.9%); SVM Asset Management (3%).

Europa Oil and Gas

6 Porter Street, London, W1U 6DD

Source: http://www.europaoil.com/contacts.aspx

Exploration and production company focused on very high impact exploration in the Atlantic off the coast of Ireland, supported by revenue from oil production in onshore UK. They hold two Underground Coal Gasification licenses around the Humber Estuary. (See: Frack Off.)

Listed on the LSE AIM exchange. Many of its main shareholders’ identities are hidden behind nominee accounts.

Rathlin Energy

Suite 1, 3rd Floor, 11-12 St. James’s Square, London, SW1Y 4LB

Source: https://beta.companieshouse.gov.uk/company/06478035

NB: Registered address. This is a current official company address; but it is not confirmed that it is an operational site rather than just a “letterbox”.

Rathlin Energy is exploring for oil and gas onshore in the East Riding of Yorkshire. As of August 2019 activity at its West Newton site was “suspended pending the analysis of the data acquired to date during the drilling and testing of the well”. (See also: Frack Off.)

UK Oil and Gas (UKOG)

The Broadgate Tower, 8th Floor, 20 Primrose Street, London, EC2A 2EW

Source: https://www.ukogplc.com/page.php?pID=7

British oil company mainly active onshore in the Weald Basin in southern England. It currently has eight licenses, including two now producing oil and others being explored or developed. Its subsidiaries include Horse Hill Developments, a company formed to drill on the Horse Hill wellsite where the company took out an injunction in 2018 to ban protests. (See also: Frack Off.)

Owners: UKOG is a PLC, listed on London’s AIM “alternative investment market” for smaller companies. Manyof its biggest investors’ identities are hidden behind nominee accounts.

1.3 Oil and gas services and shipping

When we think of the oil and gas industry, we tend to think of the headline-hitting companies listed above. These are the ones that bid for and operate “concessions” from governments to explore and drill for hydrocarbons. But behind them are a host of others, less well known but also indispensable, which work as specialist contractors and sub-contractors on different parts of the process.

In the industry jargon, hydrocarbon extraction is often divided into:

- “upstream” – finding and drilling oil and gas;

- “midstream” – transporting it, e.g., with tankers or pipelines;

- “downstream” – refining it into finished products, such as petrol or plastics.

Some contractors work in just one of these areas, others cover a range of services. In this section we just give a few prominent examples. We also include a few of the big shipping companies that operate the major oil tanker fleets.

NB: notable companies without London locations: the UK has a thriving oil support industry, however many companies are based in and around the North Sea oil hub of Aberdeen rather than in London. This includes the UK HQs of: infamous US oil services and mercenary company Halliburton; big drilling contractor Transocean, involved in the Deepwater Horizon disaster; Abbot Group, Score Group, and many more.

1.3.1 Oilfield services

John Wood Group (Wood PLC)

23rd Floor, 25 Canada Square, Canary Wharf, London, E14 5LQ

Source: https://www.woodplc.com/our-locations

Formerly Amec Foster Wheeler (2017), Wood provides engineering, production and maintenance services to the energy industry globally, including Canada’s tar sands industry and companies such as BP, Exxon Mobil, GDF Suez, Shell and EDF.

Lloyd’s Register Group

71 Fenchurch Street, London, EC3M 4BS

Source: https://www.lr.org/en-us/contact-us/?region=GBR#office-locations

LR is a global engineering, business and technical services provider to the fossil fuel and energy industry. (NB not to be confused with Lloyds of London insurance, which features in Part 2 below.)

TechnipFMC

1 St. Paul’s Churchyard, London, EC4M 8AP

Source: https://www.technipfmc.com/en/where-we-operate/europe/united-kingdom

Major oil and gas services contractor, which provides everything from platforms to pipelines and refineries. Headquarters in London, Paris, and Texas. Has paid out over $500 million in various bribery cases involving Nigeria, Brazil, Equatorial Guinea and Ghana.

Owners: listed on Paris and New York exchanges. The French government has a small 4% holding.

Valaris PLC

110 Cannon Street, London, EC4N 6EU

Source: https://beta.companieshouse.gov.uk/company/07023598/filing-history

NB: Registered address. This is a current official company address; but it is not confirmed that it is an operational site rather than just a “letterbox”.

Offshore oil drilling contractor based in London – the number one in the world by rigs managed (in 2018). It runs oil rigs for Total, Saudi Aramco and many others. Formerly known as Ensco Rowan.

1.3.2 Liquefied Natural Gas

The booming Liquefied Natural Gas (LNG) industry involves plants cooling gas into a liquid form that makes it easier for shipping. The industry lobby seeks to present gas as a “transition fuel” that is less polluting than coal or oil – an argument to keep on depleting hydrocarbon stocks and pumping out greenhouse gases because the economy is not “ready” to give up its fossil fuel addiction. In addition to carbon emissions, LNG is linked to hazardous methane leakage. See this report by Global Energy Monitor for more information.

Angola LNG

5 Hanover Square, London, W1S 1HE

Source: https://www.angolalng.com/en/contact-us/

The Angola LNG project is one of the largest ever single investments in the Angolan oil and gas industry. It is a partnership between Sonangol, Chevron, BP, Eni and Total to develop Liquefied Natural Gas.

Cheniere LNG

Berkeley Square House, Berkeley Square, London, W1J 6BY

Source: https://www.cheniere.com/contact-us/

International energy company which is the leading producer of Liquefied Natural Gas in the US.

Nigeria LNG

Heron House, 10 Dean Farrar Street, London, SW1H ODX

Source: http://www.nlng.com/Our-Company/Pages/Our-Locations.aspx

Main Nigerian liquefied natural gas-producing company with a plant on Bonny Island, Nigeria. It is owned by a consortium of the Nigerian National Petroleum Company (49%) and several oil majors: Shell (25.6%), Total (15%) and ENI (10.4%).

1.3.3 Oil shipping and gas pipelines

Mediterranean Shipping Company (MSC)

4 Thomas More Square, Thomas More Street, London, E1W 1YW

Source: https://www.msc.com/gbr/contact-us/msc-london?lang=en-gb

The Swiss-headquartered MSC is the world’s second-largest shipping line in terms of container vessel capacity.

Euronav

1st Floor, 99 Kings Road, London, SW3 4PA

Source: https://www.euronav.com/en/contact/

An Antwerp based company, listed on the New York stock exchange, which operates the world’s second biggest oil tanker fleet (after China’s COSCO, which has a UK base in Felixstowe).

Teekay Shipping

86 Jermyn St, London, SW1Y 6JD

Source: https://www.teekay.com/offices/europe/london/

One of the world’s biggest shipping companies, specialised in oil and liquefied gas tankers. Ranked as 8th biggest oil tanker company by “Tanker Operator”.

Maran (MTM)

Manning House, 22 Carlisle Place, London, SW1P 1JA

Source: http://maranuk.co.uk/contact-us.html

One of the world’s top ten oil and liquefied gas tanker fleets, part of the empire of Greece’s biggest shipping owner John Angelicoussis.

Interconnector (Fluxys and Snam)

Interconnector (UK) Limited: 4th Floor, 10 Furnival Street, London, EC4A 1AB

Source: https://www.interconnector.com/

Interconnector is the company that operates the undersea gas pipeline between Belgium and the UK. It is owned 75/25 by two of Europe’s main gas infrastructure companies: Belgium’s Fluxys and Italy’s Snam. These are two of the four main companies identified by the European Network of Corporate Observatories (ENCO) as developing new gas pipeline infrastructure across Europe, including big environmentally destructive schemes piping gas across Southern and Eastern Europe; and also in lobbying heavily to entrench Europe’s reliance on gas. See: ENCO report and company profiles.

Owners: Fluxys is owned 75% by Publigas, a Belgian public sector inter-municipal holding company. The chairman is the former mayor of Ghent. Snam is a PLC with a major holding from the Italian state, other owners are large investment funds including BlackRock.

1.4 Non-fossil energy: nuclear, biomass, dams…

With pressure growing on the fossil fuel industry, many big energy companies are gradually – if much more slowly than their propaganda suggests – moving towards more “renewable” sources. But not all of these “green energy” solutions are by any means safe or environmentally harmless. Nuclear power, of course, is itself associated with tremendous ecological contamination. Hydropower, as practised by corporations seeking to maximise profits above all, often means mega-dam projects that displace human and other animal populations, divert water supplies, and devastate river-based ecologies. Another green-spun technology is biomass – which can include simply cutting and burning up forests before they even get the chance to turn into fossil fuels.

Some key sources and further information:

- Biofuelwatch: UK biomass industry map

- Corporate Watch: A-Z of Green Capitalism (2016)

- Corporate Watch: Techno-fixes (2008)

1.4.1 Nuclear

Electricite de France (EDF)

EDF Trading (Global headquarters): 3rd Floor, Cardinal Place, 80 Victoria Street, London, SW1E 5JL

Source: www.edftrading.com/contact/our-offices

EDF is a French energy and electricity multinational. It is Europe’s largest nuclear power generator with 19 nuclear plants in France plus many more in the UK and across the world. It owns and runs all of the UK’s seven currently operating nuclear power plants. Its many other schemes include devastating dam projects that have met resistance from Brazil to Laos.

Vattenfall

1 Tudor St, London, EC4Y 0AH

Source: https://group.vattenfall.com/uk/who-we-are/contact-us

Swedish state-owned energy company which operates nuclear reactors in Sweden and Germany. Suing the German government over its decision to shut down nuclear plants following the Fukushima disaster. Also burns gas, coal, and biomass. Although its publicity focuses on wind and water, nuclear and fossil fuels remain its main energy sources.

Shareholders: Swedish government 100%

E.ON

E.ON Citigen CHP plant, 47-53 Charterhouse Street, London, EC1M 6PB

Source: https://webcache.googleusercontent.com/search?q=cache:k6IWx-v385wJ:https://jobs.eon.com/uk/job/London-Business-Administrator/582664601/; http://interengineeringlgbt.com/event/site-tour-e-citigen-combined-heat-power/;

German energy company which is also one of the “Big Six” UK energy supply companies, and has been one of the main companies pushing for continued use of coal-fired power here. Its nuclear subsidiary PreussenElektra operates three nuclear power plants in Germany. E.ON is also a shareholder in Enerjisa, owner of the Tufanbeyli coal fired power station in Turkey.

NB: E.ON’s UK head office is in Coventry – the address above is the site of its “hidden power station” providing “combined heat and power” to the Barbican and offices in the City of London (more info here). It is also home for E.ON’s “national district heating control centre”.

Enel

Enel X, 360-364 City Road, London, EC1V 2PY

Source: https://evcharging.enelx.com/eu/support-eu/contact

Major Italian energy multinational. It owns stakes in nuclear power plants in Russia, France, Spain and Italy.

NB: This office belongs to its smaller UK business Enel X, which provides “energy solutions” to businesses and “smart city” technology projects.

See also: RWE, in the mining section

Not in London: Urenco (based in Stokes Poges); Horizon Nuclear Power (based in Gloucester)

1.4.2 Biomass

Drax Group

3rd Floor, Alder Castle, 10 Noble Street, London, EC2V 7JX

Source: https://www.ofgem.gov.uk/ofgem-publications/142569

NB: this London address was confirmed as of July 1999 only. Drax’s registered address is at the Drax power station in Yorkshire.

Drax in North Yorkshire was the last big coal-fired power station built in the UK, completed in 1986, and privatised in the 1990s. As opinion turned against coal, Drax Group moved to burning wood – mostly shipped in from the forests of North America. According to Biofuelwatch, “Drax Power Station is the biggest burner of wood for electricity in the world and the UK’s single largest carbon emitter”. Drax is also now planning to convert its remaining coal-fired units to gas, and build additional new gas turbines, becoming “the biggest gas power station in Europe”. Drax has a busy corporate spin operation arguing that it can use Carbon, Capture and Storage (CCS) technology to become “carbon negative” by 2030. This includes its “Biofuel Energy CCS” (BECCS) technology, being developed with a company spun off by Leeds University’s School of Chemistry.

See also: dossier by Biofuelwatch on its #AxeDrax campaign.

Major shareholders: Invesco Limited (14%); Schroders plc (10%); Merian Global Investors (5%); Orbis Holdings Limited (5%); Blackrock (5%)

Active Energy Group plc

27-28 Eastcastle Street, London, W1W 8DH

Source: https://www.aegplc.com/contacts/contact-details/

Pollutant forestry-to-fuel biomass company, which has started operations in North Carolina. It calls itself “London’s only listed, combined, international biomass and forestry management business”.

Major shareholders: Gravendonck Private Foundation (18%); RG Spinks (4.5%); RM Derrickson (3%); InterTrade Ltd (3%).

AMP Clean Energy

1 Dover Street, London, W1S 4LD

Source: https://www.ampcleanenergy.com/contact-us

AMP provides biomass wood pellets and low carbon heat and power assets to the renewable energy industry in the UK.

Estover Energy Ltd

Central Working, Eccleston Yards, Eccleston Place, London, SW1W 9NF

Source: http://www.estover.co.uk/

Runs biomass power stations in Northumberland and Scotland, which have been met with local resistance (see p40 of this Biofuelwatch report).

Melton Renewable Energy Ltd (MRE)

33 Holborn, London, EC1N 2HT

Source: https://beta.companieshouse.gov.uk/company/09194088

NB: Registered address. This is a current official company address; but it is not confirmed that it is an operational site rather than just a “letterbox”. MRE’s main base is in Suffolk.

MRE runs five biomass power stations located at Thetford, Ely, Glanford, Eye and Westfield, which generate electricity from the combustion of poultry litter, straw, meat & bone meal, horse bedding and – like Drax – forestry wood chips.

1.4.3 Dams: hydropower companies

Statkraft

41 Moorgate, London, EC2R 6PP

Source: https://www.statkraft.com/energy-sources/Power-plants/UK/

Norway-based Statkraft is one of Europe’s largest renewable energy companies, and calls itself Europe’s biggest hydropower electricity producer. It has wind farms and hydropower plants in the UK and globally. But not everyone welcomes Stakraft’s dam building schemes. In Chile, indigenous Mapuche people are resisting the construction of several hydropower plants in their territory, including on sacred sites.

Shareholders: the parent company is owned by the Norwegian Ministry of trade.

See also: EDF, listed in Nuclear section above. And the construction section below for companies involved in dam building.

NB: not in the list: London does not have a large presence of hydropower companies. The world’s biggest dam generators are in China (above all, the massive Yangtse River Power Company) and the Americas, and do not have offices here. So far, river power is not a major source of energy in Europe – although this is set to change as major dam-building projects get underway, particularly in the Balkans.

1.5 Mining: metals and minerals

The mining industry is one of the dirtiest and most environmentally catastrophic, both in its scale and in its violence against people and planet. Mining uses huge amounts of water, often already in scarce supply. Mining operations inevitably involve the production of huge amounts of toxic waste, much of which finds its way onto cultivable land or into water sources. Waste is often stored in huge ‘tailing’ dams which then not infrequently collapse, spilling toxic sludge over whole communities, and destroying livelihoods. (See the London Mining Network’s useful explainer.) A recent dam collapse in Brazil, at a mine owned by Vale, caused 12 cubic metres of toxic tailings to be released, seeping into surrounding land and leading to the pollution of an estimated 300 km of water.

Companies greedy for valuable raw materials are likely to take shortcuts with environmental protections, if these even exist, and they ride roughshod over local needs. Violence against individuals and local communities is widespread, and may include forced evictions, as well as repression and murder of people who try to resist.

London is a major centre for the global mining industry. Many of the world’s mining giants are listed on the London, Stock Exchange, while the London Metals Exchange is the number one marketplace for industrial metals trading (See Part 2 on exchanges). The miners thus use London as a hub to raise finance, trade their products, and launder their profits.

The companies below have been selected on the basis of their size or number of operations, and on past records of environmental violence. Some key sources and further information: London Mining Network; Environmental Justice Atlas, The Rivers are Bleeding (War on Want)

NB: who’s not on the list: Some multinationals involved in coal mining – notably, Glencore and RWE – are listed below. However, the world’s very biggest coal miners are largely state-owned corporations – notably the massive Coal India Ltd, and the various Chinese coal companies – which do not have a presence in London. The world’s biggest private sector coal miner, US corporation Peabody Energy, has a “London” office that is actually in Guildford.

In terms of metals, notable companies without London offices include Anglo Gold Ashanti, Newmont Mining, and Eldorado Gold. Lonmin, the infamous London-based gold mining company involved in the 2012 Marikana massacre, has recently been bought by Sebanye Stillwater, based in South Africa.

RWE

60 Threadneedle Street, London, EC2R 8HP

Source: https://www.group.rwe/en/the-group/countries-and-locations/london

RWE is a major German energy company, notorious as Western Europe’s biggest coal burner. Its devastation of the Hambach forest near Cologne for open-cast coal mining continues to meet fierce resistance. RWE also has aggressive plans for burning millions of tonnes of wood – including in the UK, where it is planning to convert a second power station to biomass. Its biomass investment will mean more destruction of forests in Canada, the US and elsewhere.

Major shareholders: KEB Holding, Blackrock

Glencore

50 Berkeley Street, London, W1J 8HD

Source: https://beta.companieshouse.gov.uk/search?q=glencore https://architizer.com/projects/glencore-london-offices/

NB: reportedly will move to 18 Hanover Square, London W1S 1HD later in the second half of 2020.

Mining and commodities trading company, the world’s largest mining company by revenue. It is one of the world’s largest producers of zinc, copper and other metals, and also a major global coal miner. The company was formed from the merger of Glencore and XStrata in 2013: both have a terrible history of environmental fines, fatalities, health problems, dumping toxic assets, contamination of water, air, land. Glencore is part-owner of Cerrejon, a huge open-pit coal mine in Colombia (see Anglo American.) See: London Mining Network; EJAtlas.

Anglo American PLC

20 Carlton House Terrace, London, SW1Y 5AN

Source: https://www.angloamerican.com/sustainability/contacts

UK and South African multinational that is the world’s largest producer of platinum and a major producer of diamonds, copper, nickel, iron ore, metallurgical and thermal coal. Anglo American has violated indigenous land rights across the globe and polluted the water, agricultural land and air of many communities. It is co-owner (with Glencore and BHP) of the huge open-pit coal mine Cerrejon, in Colombia, where pollution and dust from the mine has caused contamination on a massive scale. In Brazil, it is facing strong opposition from local communities over its plan to expand a large tailings dam, the collapse of which would have horrific consequences. In the state of Chile, residents of El Melón are amongst those fighting its attacks on their land and water sources. See: London Mining Network. Also: EJAtlas company page.

BHP Group PLC

Nova South, 160 Victoria Street, London, SW1E 5LB

Source: https://www.bhp.com/contact-us/

BHP is one of the world’s largest mining companies, with 30 operations in 13 countries. It is among the top 25 fossil fuel producers worldwide. It is the joint owner of the Cerrejon coal mine (see Anglo American), and was responsible for the massive Samarco dam collapse in 2015, which spilt 45 million cubic metres of mining waste into the Rio Doce and its tributaries. BHP’s proposed copper mine in Tonto National Forest in the US would destroy 3,000 hectares of public land, harm endangered species, and threaten massive water loss and contamination. See: London Mining Network; EJAtlas.

Rio Tinto

6 St James’s Square, London, SW1Y 4AD

Source: https://www.riotinto.com/en/footer/contact

Rio Tinto is a huge multinational metals and mining corporation. It is a world leader in the production of aluminium, iron ore, copper, uranium, coal, and diamonds. According to the Carbon Majors Database it was responsible for 0.75% of the world’s carbon emissions between 1988 and 2015. Its Oyu Tolgoi copper and gold mine under development in Mongolia uses vast quantities of water in a desert region and poses a threat to pastoralist communities. In the USA, hundreds of premature deaths are blamed on air pollution from the Bingham Canyon mine: the single largest open pit mining operation and the deepest excavation of its kind in the world. See: London Mining Network; EJAtlas.

Vedanta Resources

30 Berkeley Square, Mayfair, London, W1J 6EX

Source: https://www.vedantaresources.com/pages/reachus.aspx

Global diversified metals and mining company whose main products are copper, zinc, aluminium, lead and iron ore. Vedanta’s plans for an open-pit bauxite mine in the Niyamgiri Hills in Orissa, India, threatens the Dongria Kondh community, who have resisted with a ten year struggle. In Zambia, thousands of victims of pollution from a copper mining subsidiary of Vedanta have been seeking justice for over 15 years.

See also: Foil Vedanta website.

Owners: Majority owner is Chair and CEO Anil Agarwal. Around a third of Vedanta shares were formerly traded on the London Stock Exhange until 2018, when Agarwal bought them back and delisted the company.

ArcelorMittal Limited

7th Floor, Berkeley Square House, Berkeley Square, London, W1J 6DA

Source: https://corporate.arcelormittal.com/site-services/contact-us

The world’s largest steel producer, also has iron ore and coal ore mining operations. Facing criminal charges and court cases over polluting activities in South Africa, Italy, Bosnia and Ukraine. Chairman and CEO is the billionaire Lakshmi Mittal.

Owners: the Mittal family owns 40% of the shares. Other shares are publicly traded, with many held by the usual global investment funds.

Nornickel

The St Botolph Building 138, Houndsditch, London, EC3A 7AR

Source: https://beta.companieshouse.gov.uk/company/04614811

https://www.nornickel.com/upload/iblock/592/event_28.12.15_49_prekrashhenie_engl.pdf

NB: Registered address. This is a current official company address; but it is not confirmed that it is an operational site rather than just a “letterbox”.

“[The Russian city of] Norilsk is one of the 10 most polluted cities in the world and Norilsk Nickel [now renamed Nornickel], a big mining and the metallurgical complex, is to blame for that […] The citizens experience noxious gases emitted from the mining and industrial activities, while even more extreme conditions of pollution are experienced daily by the workers in the mining and metallurgical complex. The pollution consists of sulphur dioxide, nitrogen oxides, carbon monoxide, phenol, and chlorine that have contaminated both air and water and therefore had an negative impact on local lakes and the fragile tundra ecosystem.” From: Environmental Justice Atlas.

Barrick Gold

1st Floor, 2 Savoy Court, Strand, London, WC2R 0EZ

Source: https://www.barrick.com/contact-us/default.aspx

Barrick Gold is the second largest gold mining company in the world. It has faced allegations of rape, murder, forced evictions, and other violent abuse. Its polluting history includes a massive one million liters of cyanide solution spilled into five rivers in Argentina, and subsequent cyanide spills shortly afterwards because of a failure to put in place improvements. Acacia Mining, a subsidiary of Barrick Gold, also has a history of violent abuses and was recently fined for pollution at a Tanzanian mine.

See also: Protest Barrick website; EJAtlas page.

Ownership: PLC (New York listing), largely owned by the big global investment funds.

Vale

Vale Europe Ltd: Suite 1, 3rd Floor 11-12 St. James’s Square, London, SW1Y 4LB

Source: https://beta.companieshouse.gov.uk/company/00137114

NB: Registered address. This is a current official company address; but it is not confirmed that it is an operational site rather than just a “letterbox”.

Brazilian mining giant Vale is the world’s largest producer of iron ore and nickel. It also produces manganese, ferroalloys, copper, bauxite, potash, kaolin, and cobalt, and operates nine hydroelectricity plants. Vale has had two catastrophic dam failures in Brazil: the first was in Mariana, in 2015, when 19 people were killed, whole villages were buried and thousands of people left homeless. In 2019, at least 65 people were killed when the tailings dam at Brumadinho collapsed.

See also: Environmental Justice Atlas company page.

Ownership: PLC listed on Sao Paulo, New York and other exchanges, largely owned by the big global investment funds.

Antofagasta

Cleveland House 33 King Street, St James’s, London, SW1Y 6RJ

Source: https://www.antofagasta.co.uk/contact/

Operates the Los Pelambres copper mine in north central Chile, which stores its tailings waste in the largest tailings dam in Latin America. It is located above the small town of Caimanes where residents are struggling with water shortages as a result of the dam built upstream. The company has been charged with numerous violations of its environmental permits and is responsible for many toxic spills in the Coquimbo region, including one where 13,000 litres of copper concentrate were dumped directly into the Choapa River.

See also: London Mining Network.

Fresnillo

Investor Relations office: 2nd Floor, 21 Upper Brook Street, London, W1K 7PY

Source: http://www.fresnilloplc.com/contacts/corporate-offices/

Largest silver ore producer in the world. The company operates eight silver and gold mines in Mexico, six of which have documented cases of serious violence or environmental impacts associated with them. For example, La Parreña, where the company is accused of contaminating a river by dumping toxic waste (copper sulphate) into the Milpillas stream which provides water for 1,900 hectares of agricultural production.

See also: War On Want.

Hochschild Mining

17 Cavendish Square, London, W1G 0PH

Source: http://www.hochschildmining.com/en/site_services/contact_us

Several local communities oppose mining exploration near the Inmaculada gold and silver mine in Ayacucho department in southern Peru, owned and managed by Hochschild Mining. Locals have demanded the withdrawal of the company whose operations threaten to contaminate the waters of the Huancute, Patarí and other rivers.

See also: War on Want.

Condor Gold PLC

22a St James’s Square, London, SW1H 4JH

Source: http://www.condorgold.com/contact

Condor Gold is a gold exploration company that operates mining projects in Nicaragua. Residents near the La India mine in Leon have challenged the company for failing to adequately consult them and for damaging community water wells during its exploration activities. In 2016, around 500 local residents protested against Condor Gold for allegedly attempting to evict them from their properties.

See: War on Want.

GCM Resources

3 Bunhill Row, London, EC1Y 8YZ

Source: http://www.gcmplc.com/shareholders/contacts

London-based company behind the Phulbari open-pit coal mining project in Bangladesh. Formerly known as Asia Energy. The Phulbari mine would lead to the displacement of 230,000 people and massive environmental pollution. It is currently halted as a result of strong and sustained resistance by local people, with international solidarity in London and elsewhere,in the face of murderous repression.But GCM is still trying to restart the project.

See also: phulbarisolidarity.

1.6 Earth-killing infrastructure: engineering and construction

The energy and mining companies – including fossil fuels, nuclear and dams – do not act alone. They rely on major infrastructure support, including from the engineers who develop and support drillheads, pipelines, or nuclear reactors; and the construction companies who build their dams and power stations.

This section lists just some of the most prominent engineering and construction companies. It includes some global behemoths, and the top UK building firms that work on energy infrastructure and other big polluting projects such as motorway building. We also include a sub-section on cement production.

1.6.1 Energy conglomerates

We’re using this category for some big companies that have fingers in many pies: they could be listed in several sections.

Koch Industries

Koch Supply and Trading: 4th Floor, 20 Gresham Street, London, EC2V 7JE

Source: https://www.ksandt.com/

The Koch family’s industrial empire includes oil refineries, chemical plants, fertilisers, paper mills, cattle ranches, commodities trading, investment funds … It might be quicker to list earth-wrecking activities they’re not involved in. They employ 130,000 people, just over half of those in the US but with a presence in 60 countries.

Owners: Koch family members. Koch Industries, with its many subsidiaries, is one of the world’s biggest privately owned companies. Charles Koch, and his brother David until his death in August 2019, have vigorously promoted their interests with large scale funding of an array of right-wing politicians and, above all, think tanks. Main agenda points have been climate change denial and opposition to environmental regulation or development of alternatives to fossil fuels, as well as union-busting and general free marketeering.

Noble Group

Office 6.01 Nova North, 11 Bressenden Place, London, SW1E 5BY

Source: https://www.noblegroupholdings.com/contact-us/

Noble Group is a Hong Kong-based commodities conglomerate. Subsidiaries include metals mining and trading, liquefied natural gas, shipping, oil rig contracting, and more. It was delisted from the Singapore stock exchange in 2018 after a major fraud scandal, with investigations ongoing, and has since restructured.

1.6.2 International engineering and construction giants

Siemens

Siemens Mobility Limited: 7th Floor, Euston House, 24 Eversholt Street, London, NW1 1AD

The Crystal (Siemens offices and exhibition centre): 1 Siemens Brothers Way, Royal Docks, London, E16 1GB

Source: https://new.siemens.com/uk/en/company/about/siemens-uk-locations.html https://thecrystal.org

Giant German conglomerate best known for industrial electrical engineering and consumer electronics. Siemens is providing signalling for the Carmichael mine: Indian mining company Adani’s plan for the biggest coalmine in Australian history.

(NB: UK head office is in Frimley, Surrey.)

Bechtel Corporation

11 Pilgrim Street, London, EC4V 6RN

Source: https://www.bechtel.com/about-us/offices/

The USA’s biggest building company, largely focusing on major energy and infrastructure schemes across the globe. Its business units include “Mining and Metals”, “Oil, Gas & Chemicals”, and “Nuclear, Security and Environmental”. It’s hard to know where to start with a list ofBechtel scandals and devastating projects: from massive war profiteering with a $680 million Iraq war contract, through sub-par Nuclear waste facilities, to pushing up water prices in Bolivia. Alongside the daily business of building dams, coal mines, motorways, pipelines, liquefied natural gas plants, nuclear power plants, chemical weapons stores, etc. Bechtel is highly connected in US politics, with a record of executives serving as cabinet ministers.

See also: wikipedia page with many more links.

Ownership: remains controlled by the Bechtel family. Chairman and CEO Brendan Bechtel is fifth generation of the family in charge.

Vinci

VINCI Concessions UK: 1 Eversholt Street, London, NW1 2DN

Morgan VINCI Ltd: 77 Newman Street, London, W1T 3EW

Eurovia UK (transport construction subsidiary): 26 Store Street Fitzrovia Lane, London, WC1E 7BT

Taylor Woodrow (UK construction subsidiary): 286 Euston Road, Euston Tower Level 33, London, NW1A 3DP

Source: https://www.vinci.com/vinci.nsf/en/locations/pages/region_greater_london.htm

Massive French construction multinational, with numerous brands and subsidiaries, involved in a long list of devastating projects. It makes its biggest profits running much of the French toll-paying motorway system. Planned developer of the Notre Dame des Landes airport in western France, which was scrapped in 2019 after an epic campaign of resistance including the long-running ZAD land occupation. Accused of using forced labour in Qatar, bulldozing migrant camps in Calais, and engaging in corruption and massive environmental destruction in Russia’s Khimki Forest motorway scheme. See Corporate Watch company profile (from 2017). Recently, its subsidiary Spiecapag is involved in the Adani Carmichael coal mine in Australia, which is being vigorously resisted.

Owners: French PLC. Its biggest owners include BlackRock and the government of Qatar, amongst many other global investment funds.

1.6.3 UK big builders

Balfour Beatty

5 Churchill Place, Canary Wharf, London, E14 5HU

Source: www.balfourbeatty.com/contacts/

Balfour Beatty Investments: 350 Euston Road, Regent’s Place, London, NW1 3AX

Source: http://www.balfourbeattyinvestments.com/company/about.aspx

Major British building company focusing on big infrastructure. Heavily involved in road building, and one of the main contractors in the UK’s white elephant HS2 rail scheme. Infamous for its record of trade union blacklisting. Also responsible for dams in Asia and Africa – was involved in early plans for Turkey’s Ilisu dam, but later pulled out after large scale protests.

Kier Group

33 Foley Street, London, W1W 7TL

Source: https://www.kier.co.uk/contact/our-locations/?area=london&id=3545

Major UK construction company. Works on energy infrastructure – including nuclear – and road building, as well as house building. Another of the big UK builders involved in the infamous union-busting blacklist.

Sir Robert McAlpine

4th Floor, 63 St Mary’s Axe, London, EC3A 8AA

Source: https://www.srm.com/office-locations/london/

Major UK construction and civil engineering firm which works on oil and gas, nuclear, dams, chemical and mining sectors as well as other high-profile building schemes. It was the main building company responsible for setting up the “Consulting Association” union-busting blacklist scheme.

Morgan Sindell

Kent House, 14-17 Market Place, London, W1W 8AJ

Source: https://www.morgansindall.com/contact-us/

Major British construction and engineering firm. Its infrastructure division works on nuclear and defence infrastructure, including at the Faslane nuclear submarine base. It also has a sideline in prison building.

Amey UK

10 Furnival Street, London, EC4A 1AB

Source: http://tpt.amey.co.uk/contact-us/

Sixth in the list of UK construction companies, Amey is also well known for engineering services and “facilities” management to the energy industry, road maintenance, airports, and more. It also maintains 61 British prisons, and has gone further into the profitable “justice” business with its GEOAmey prisoner transporting joint venture. Also known for cutting down thousands of trees in Sheffield as part of its PFI deal with the council.

Owner: bought by Spanish building company Ferrovial.

1.6.4 Cement producers

Cement is a massively destructive product: according to the Chatham House think tank, it is responsible for 8% of CO2 emissions. Concrete production is also linked to extensive soil erosion, water pollution and flooding.

None of the major cement producers are based in London. The biggest of all are based in China and serve that country’s massive construction industry. The UK’s cement needs are served by multinationals which largely have centres outside the capital: LafargeHolcim’s UK plant is in Leicester; Heidelberg’s building subsidiary Hanson is based in Maidenhead; and the Mexican giant Cemex has a UK HQ in Rugby. Below we list offices for a subsidiary of one other major cement producers.

CRH (Tarmac)

Tarmac: Level 4, 40 Strand, London, WC2N 5RW

Source: http://tarmac.com/location-finder//find-a-site?location=London

CRH is the 7th largest cement multinational. It is an Irish registered company, listed on the London Stock exchange. In the UK, it is best known as the owner of Tarmac. CRH has been involved in several alleged corruption controversies in Ireland and Poland.

1.7 Agribusiness

Corporate agriculture has become infamous for its negative effect on the planet and the climate. The list for this sector is thinner – London is not a hub for agribusiness companies in the same way as hydrocarbons or mining. UK agribusiness tends to be regionally based: e.g., Bernard Matthews’ famous Norfolk poultry farming, or fishing fleets in coastal ports. A major exception, listed below, is the giant of ABF.

The biggest global agricorps are US companies (particularly for soya and meat), with East Asia cornering the palm oil and sea food industries. The world’s largest chemical fertiliser giant – also Europe’s biggest buyer of natural gas – Yara, is a Norwegian company with no London base (see Corporate Watch profile). We’ve also included in this section major global food companies that are key customers of the big agribusiness corps, and in some cases also run their own agro-industry supply chains.

ABF (Associated British Foods)

Weston Centre 10 Grosvenor Street London, W1K 4QY

Source: www.abf.co.uk/m/contact-us

British consumer and agribusiness conglomerate. It owns household brands including Ovaltine, Ryvita, Twinings tea, and many more. Agribusiness division AB Agri is involved in animal feed, biofuels, and other products in the UK and China. Its AB Sugar division is one of the world’s biggest sugar empires, including Silver Spoon (which buys almost all UK sugar beet), Ilovo Sugar in southern Africa, Azucarera in Spain, AB Sugar China, and other companies. According to the World Wildlife Fund: “The cultivation and processing of sugar produce environmental impacts through the loss of natural habitats, intensive use of water, heavy use of agro-chemicals, discharge and runoff of polluted effluent and air pollution.” On top of all that, ABF also owns the infamous Primark clothing chain, renowned for miserable labour conditions and the death of over 1,000 people in the Rana Plaza factory collapse.

Owners: 55% owned by Wittington Investments, other shares publicly traded.

Cargill

3rd Floor, 77 Queen Victoria Street, London, EC4V 4AY

Source: www.cargill.co.uk/en/london-location

The largest privately held company in the world, Cargill is regarded as one of two companies most closely linked to Brazilian deforestation for its soya destined for the livestock industry. Besides Amazon destruction, it is also involved in UK mega factory farms, is one of the world’s biggest traders in palm oil, and is tied to rainforest destruction in South East Asia, deforestation in West Africa and child slavery. Cargill has more than 60 subsidiaries.

Owners: The Cargill-Macmillan family, one of the wealthiest in the US, reportedly own over 85% of the company.

Archer Daniels Midland (ADM)

ADM Investor Services International Limited: Millennium Bridge House, 2 Lambeth Hill, London, EC4V 3TT

Source: www.admisi.com/contact

ADM is a major US food processing company dealing in Amazon soya, palm oil and biofuels, among other commodities. Prior to joining ADM, the company’s CEO Juan R Luciano spent 25 years at Dow Chemical. He also sits on the board of directors of pharma giant Eli Lilly and palm oil plunderers Wilmar International. ADM have various joint ventures and a history of cooperation with Wilmar. NB: the London office belongs to ADMSI, an investment brokerage subsidiary.

Owners: listed company, owned by big investment funds including Vanguard, as well as State Farm Investment Management Corp.

Louis Dreyfus Trading

The Crane Building, 22 Lavington Street, London, SE1 0NK

Source: https://www.ldc.com/global/en/about-us/locations1/

An enormous agribusiness covering all parts of the supply chain, involved in Amazon soya. A subsidiary of the Dutch-based Louis Dreyfus Company (LDC).

Owners: billionaire Margarita Louis-Dreyfus whose family trust Akira now owns over 95% of the holding company.

Olam International

New Zealand House, 80 Haymarket London, SW1Y 4TE

Source: https://www.olamgroup.com/contactus.html

Singapore-based company and major producer of cash crops, particularly palm oil. Olam is engaged in massive deforestation and has been accused of serious human rights abuses. Allegations include razing an area of pristine forest in Gabon the size of Washington DC for its rubber plantations and driving land grabs and evictions in Laos.

Owners: Olam’s largest shareholders are Temasek Holdings and Mitsubishi Corporation – Singaporean sovereign wealth fund and Japanese bank.

Unilever plc

Unilever House, 100 Victoria Embankment, London, EC4Y 0DY

Source: https://www.unilever.com/contact/unilever-registered-offices/

Massive Dutch-British consumer goods company which owns numerous household food and cosmetics brands, and has a long record of environmental scandals. Major users of palm oil, connected to rainforest clearances in South East Asia and West Africa, as well as to child labour. Also identified by Break Free from Plastic as one of the world’s top ten plastics users.

Tata Group

18 Grosvenor Place, London, SW1X 7HS

Source: www.tata.com/contact-us#

Massive Indian multinational conglomerate with over 700,000 employees. It could feature in a number of sections: various divisions own coal mines, power plants, steel mills, hotel chains, one of the word’s biggest IT companies, Jaguar Landrover cars, and a massive list of household consumer products. Tata Global Beverages, which includes the Tetley tea brand, is one of the world’s biggest tea and coffee plantation owners. Tata’s iron works, chemical plants, and plantations have been connected to land grabs, police shootings, pollution incidents, workers’ disputes, and more.

See also: Wikipedia, Environmental Justice Atlas.

Owners: Tata family. The majority of shares are owned by the Tata Sons holding company, which in turn is owned by family trusts. The family business goes back to the 1860s, when it was involved in the opium trade. Some Tata subsidiaries have a minority of shares traded in the open market.

Burger King

4th Floor, 2 Fouberts Place, W1F 7PA

Source: www.burgerking.co.uk/privacy

Huge global meat user. A major customer of Cargill. In a 2016 report by the Union of Concerned Scientists, BK scored a zero for failing to make any notable progress round the issue of deforestation. The company has since pledged to eliminate deforestation from its supply chain – by 2030!

Owners: the parent company is a Canadian holding company called Restaurant Brands International (RBI), 32% of which is owned by Brazilian private equity fund 3G Capital; another major shareholder is Morgan Stanley (see the banks section in Part 2.)

(NB: many of the same points could be made about McDonalds as Burger King. The only reason we don’t include them is because the London office is outside our map area in East Finchley.)

1.8 Plastics and other chemical polluters

Like agribusiness, the chemicals industry does not have the same presence in London as hydrocarbons or mining. Only two of the global top ten plastics producers have offices in the city. Dow DuPont, the world’s biggest chemical company and number one plastics producer, notorious for the Bhopal disaster, is about to set up its UK and Ireland base in a “state-of-the-art business park” in Stockport. The second biggest UK-based company, Linde, has its HQ in Guildford, Surrey.

BASF

BASF Metals Limited: 21st Floor, Bishopsgate, London, EC2N 4AY

Source: https://www.basf.com/gb/en/who-we-are/BASF-in-the-United-Kingdom/BASF-Metals-Limited–BML-.html

BASF is the world’s second largest chemicals company (after the merged Dow Dupont). It is among the biggest manufacturers of plastics and of pesticides and also has a biotech arm, BASF Plant Science. (NB: The London office belongs to its Metals division.)

Ineos

Ineos HQ: 38 Hans Cres, London, SW1X 0LZ

Source: www.ineos.com/contact/

Ineos oil and gas: Anchor House, 15-19 Britten St, London, SW3 3TY, UK

Source: www.ineos.com/businesses/ineos-oil–gas…/

Ineos is the UK’s biggest chemical company, and the world’s fifth biggest. It operates through dozens of subsidiary companies. The Petroineos joint venture with China’s state oil company CNPC is Europe’s biggest oil refiner. Its flagship base is Grangemouth, which is “home to Scotland’s only crude oil refinery and produces the bulk of fuels used in Scotland.” Ineos’ “Dragon Ship” LNG tankers ferry US shale gas to the site. Ineosalso has its own oil and gas exploration arm, well known for its attempts to start fracking in the UK, which has bought up the majority of shale gas exploration licenses here.

See also: detailed company profile from Spinwatch / Powerbase; new Corporate Watch profile on Ineos’ billionaire owner Jim Ratcliffe.

Owner: billionaire Jim Ratcliffe, listed as Britain’s richest person by the Sunday Times Rich List 2018, founded the company and still owns 60%. Ineos is one of the UK’s biggest privately held companies (as opposed to listed PLCs).

Lyondellbasell

4th Floor, One Vine Street, London, W1J 0AH

Source: https://www.lyondellbasell.com/en/london-office/contact-us/

Major chemical multinational, registered in the Netherlands but with a London HQ. It is a plastic specialist, the world’s third biggest plastics producer. It describes itself as the leading US and European producer of polypropyenes – one of the plastics widely used in packaging responsible for massive environmental pollution.

Owners: PLC, listed on New York SE.

Coca-Cola

1A Wimpole St, London, W1G 0EA

Source: https://www.coca-cola.co.uk/about-us/contact-us

We include Coca Cola here as the world’s number one plastic consumer products polluter, according to Break Free From Plastic. There are plenty of other environmental and human scandals linked to the company, from groundwater depletion in India to support for Apartheid South Africa or the Israeli far-right.

NB: Pepsico’s UK office is in Berkshire.

2. Secondary planet-killers

2.1 Banks

The City of London is one of the world’s main finance hubs, second only to New York. It is particularly important as a trading and money laundering centre for Europe, the Middle East and Africa (EMEA, in bankers’ jargon), and for oil and other “commodities”. Three of the world’s major investment banks have their headquarters here: HSBC, Barclays, and RBS. And all of the other big global banks have London offices.

Banks play an essential part in ecocidal capitalism, channelling the money that companies need to develop new projects. Their key roles include:

- Lending money directly to companies – in big cases, these may be multi-million dollar “syndicated loans” involving “syndicates” of numerous banks.

- Arranging for other investors to put their money into companies through bonds and shares.

- Trading these bonds and shares.

- Helping companies arrange takeovers, buy-outs, property sales, and other corporate deals.

This section lists: first, the state-owned Chinese “Big Four” banks; then, the top 10 global investment banks, as well as other notable multinational investment banks. All of them, without a single exception, are involved in funding the fossil fuel drillers, coal diggers, forest clearers, river foulers, and other earth-wreckers – including the companies listed in Part 1, and many more.

The Chinese state-owned banks have been largely focused on financing China’s rapid industrial growth – including the country’s massive coal industry, which accounts for much of the worldwide production of the dirtiest of fuels. Increasingly, they are also becoming involved in deals across the globe. They are leading players in the industrial exploitation of Africa and other regions where China is increasingly replacing the “West” as main neo-colonial power.

But, for now, the US, European and Japanese multinationals are still the biggest of all fossil fuel funders. According to research by the Rainforest Action Network, Banktrack, and other partners, the world’s top 33 private sector banks have pumped $1.9 trillion into financing fossil fuels since 2016. And London is where many of these deals are done.

Key sources and further reading:

- Banktrack: website has a big list of hundreds of banks worldwide, with profile pages identifying their “dodgy deals”.

- Standard & Poors’ list of world’s 100 biggest banks (by total assets)

- ADV Ratings list of top (privately-owned) investment banks 2019 (by investment banking revenue)